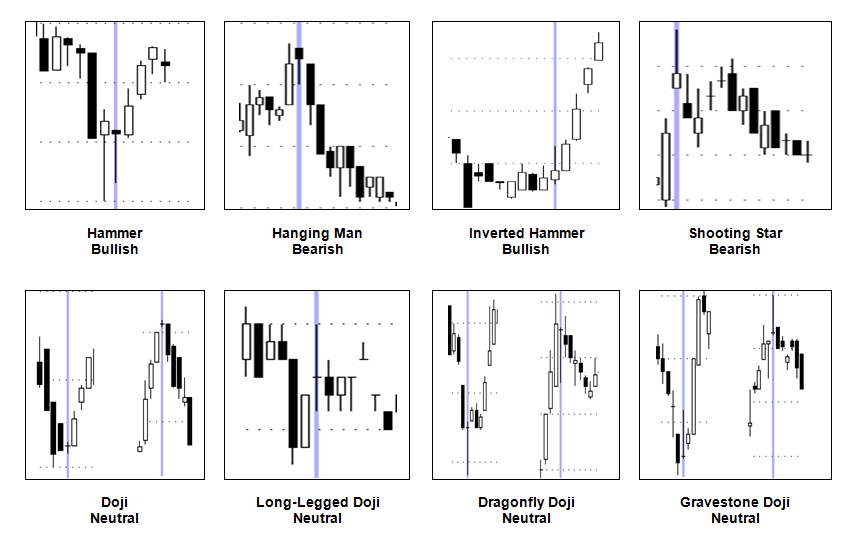

Single Candlestick

The following are single candlestick formations that can signal possible bearish or bullish scenarios in the succeeding day(s) ahead. Individual candlesticks work best when paired with a confirmation candlestick on the next day to increase the chances of getting the technical analysis right. These work well on various time frames from daily to yearly charts.

Reminder: Candlesticks serve as guidelines. They are not rigid rules such that if a bullish candlestick appears, then it would be certain that the stock would go up the next day. Characteristics of candlesticks vary as well. For example, a hammer candlestick with a considerably long shadow, but not as long as it should be can still be considered as a hammer formation.

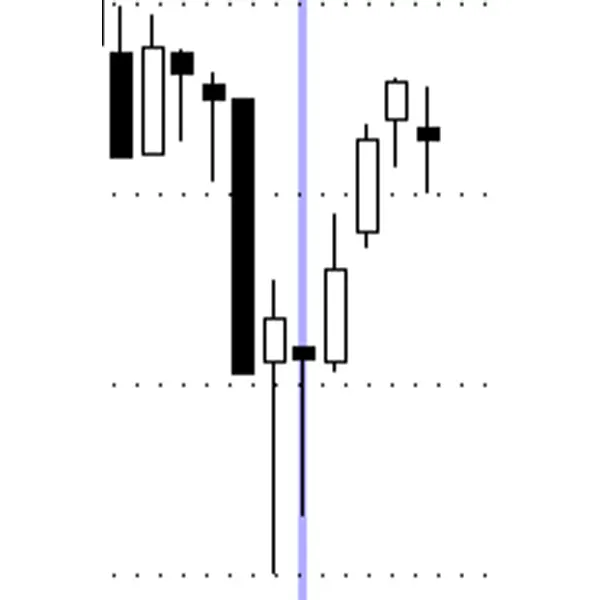

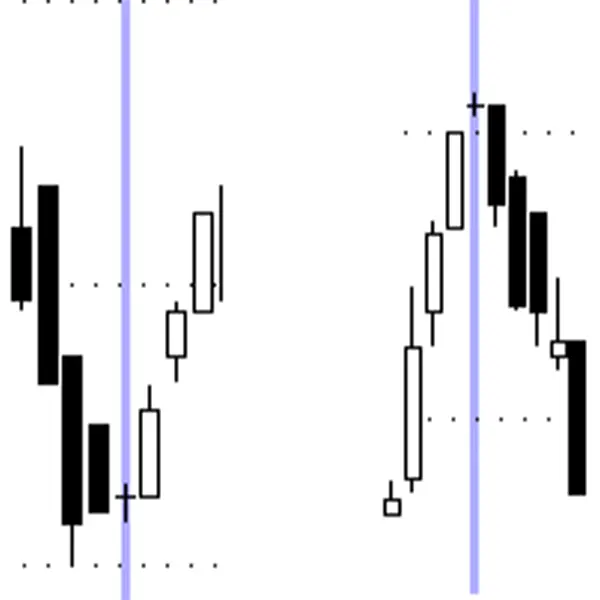

Hammer

- Appears in a downtrend

- Must have small real bodies and long lower shadow ( as much as possible shadow is twice the height of real body)

- Real body can either be white or black.

- More bullish if the real body is white than black

- More bullish if the lower shadow is very long

- Effect: Signals a stop in a downtrend.

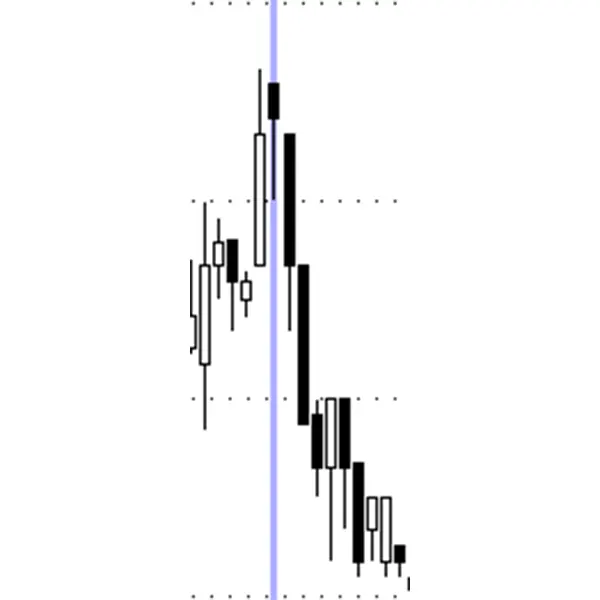

Hanging Man

- Appears in an uptrend

- Must have small real bodies and long lower shadow ( as much as possible shadow is twice the height of real body)

- Real body can either be white or black.

- More bearish if the real body is black than white

- More bearish if the lower shadow is very long

- Effect: Signals a lull or peak in an uptrend.

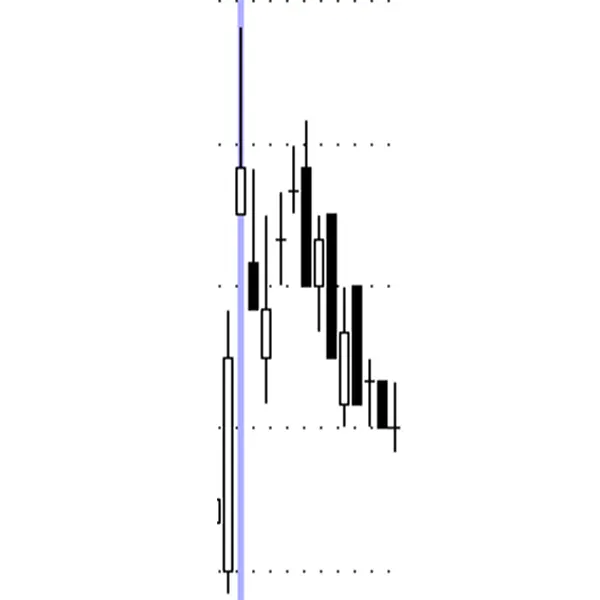

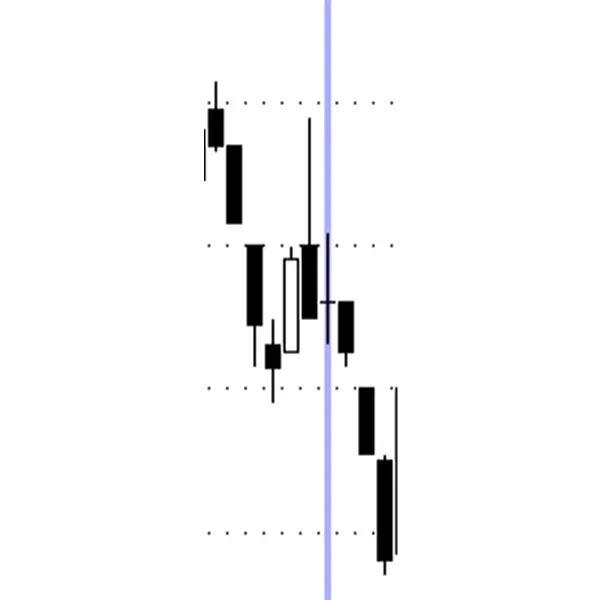

Inverted Hammer

- Appears in a downtrend

- Must have small real bodies and longer upper shadow

- Real body can be black or white

- More bullish if the real body is white than black

- Effect: Signals a bottom.

Shooting Star

- Appears in an uptrend

- Must have small real bodies and longer upper shadow

- Real body can be black or white

- More bearish if the real body is black than white

- Effect: Signals a peak.

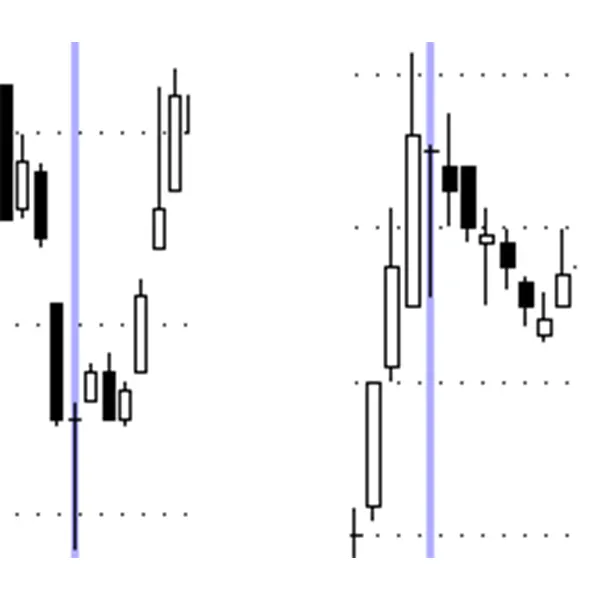

Doji Star

- Appears either in a downtrend or uptrend

- Must have a very tiny or no real body at all

- Has small shadows on either end of the body

- A bullish or bearish candlestick on the succeeding day can confirm a potential reversal

- Effect: Signals a potential major reversal.

Long-Legged Doji

- Appears on downtrends or uptrends

- Also known as the Rickshaw Man candlestick

- It shows indecisiveness in the market

- Highly dependent on the next candlestick, whether it would have a bullish or bearish rally

- Effect: Signals neutrality in the market.

Dragonfly Doji

- Appears either in a downtrend or uptrend

- Must have a very tiny or no real body at all and very long lower shadow

- A bullish or bearish candlestick on the succeeding day can confirm a potential reversal

- Effect: Signals a potential major reversal from a downtrend or uptrend.

Gravestone Doji

- Appears either in a downtrend or uptrend

- Must have a very tiny or no real body at all and very long upper shadow

- A bullish or bearish candlestick on the succeeding day can confirm a potential reversal

- Effect: Signals a potential major reversal from an uptrend or downtrend.