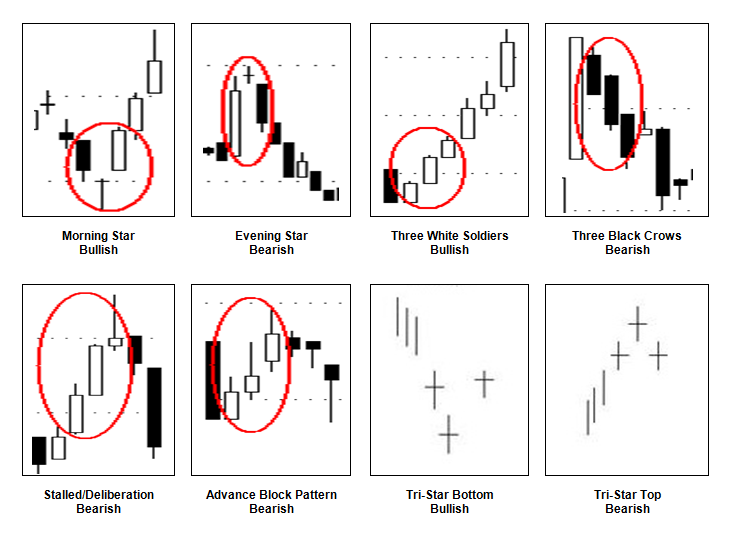

Triple Candlesticks

The following are triple candlesticks formations that can signal possible bearish or bullish scenarios in the succeeding day(s) ahead. Triple candlesticks are more powerful formations that can signal trend reversals. These work well on various time frames from daily to yearly charts.

Reminder: Candlesticks serve as guidelines. They are not rigid rules such that if a bullish candlestick appears, then it would be certain that the stock would go up the next day. Characteristics of candlesticks vary as well. For example, a hammer candlestick with a considerably long shadow, but not as long as it should be can still be considered as a hammer formation.

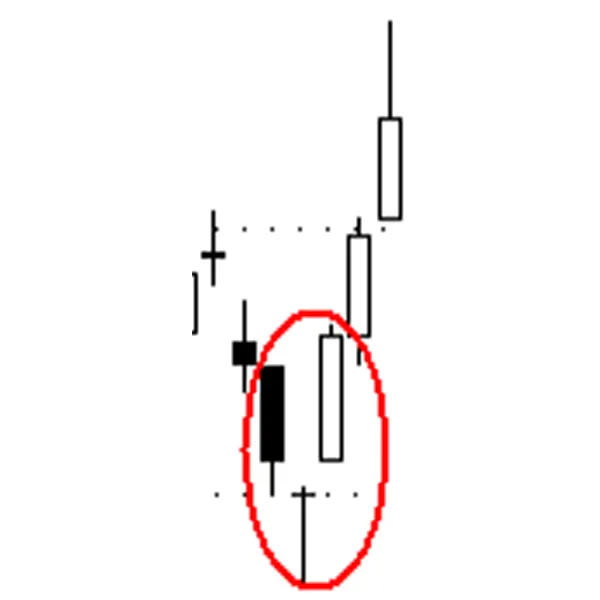

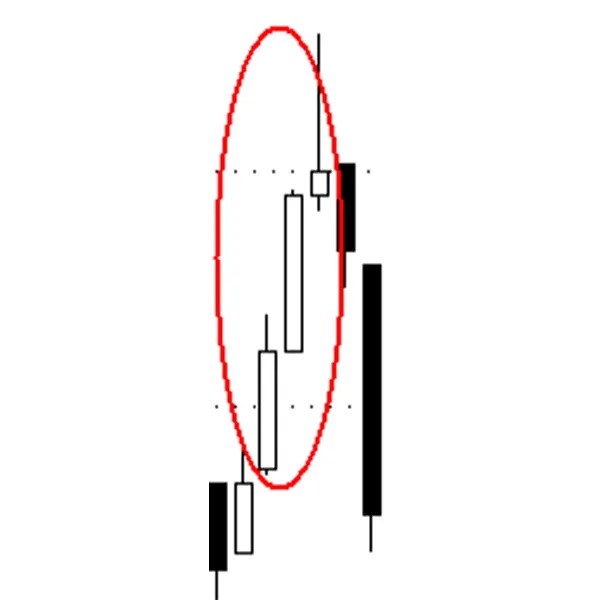

Morning Star

- Usually appears in a downtrend pattern

- Comprises of a tall black real body candlestick followed by a small real body candlestick, which gaps lower. Then, a white real body candlestick forms that is at least within the first candlestick’s body

- The middle candlestick can be black or white

- Ideally, the middle candlestick should have a gap after the black candlestick and another gap before the white candlestick

- The pattern is more potent if the middle candlestick is a Doji

- The pattern is more potent also if the white candlestick penetrates more the black candlestick’s real body

- Effect: Signals a bottom reversal pattern

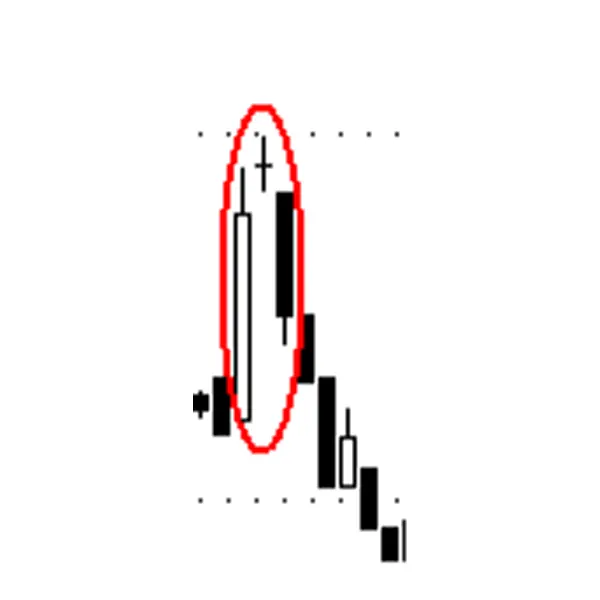

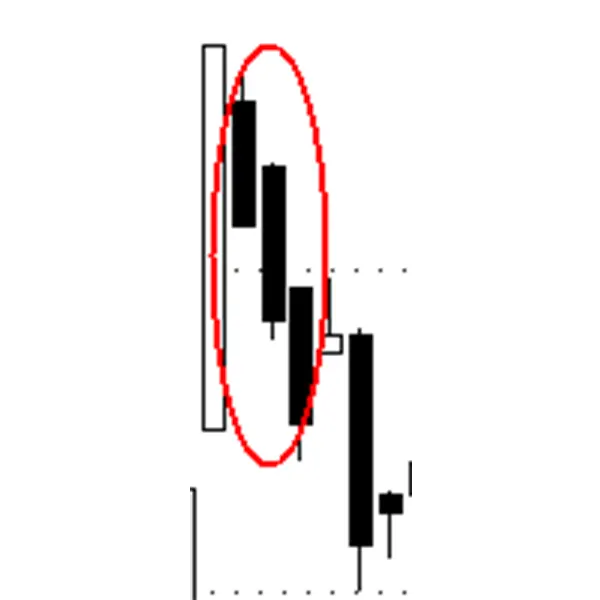

Evening Star

- Usually appears in an uptrend pattern

- Comprises of a tall white real body candlestick followed by a small real body candlestick, which gaps higher. Then, a black real body candlestick forms that is at least within the first candlestick’s body

- The middle candlestick can be black or white

- Ideally, the middle candlestick should have a gap after the white candlestick and another gap before the black candlestick

- The pattern is more potent if the middle candlestick is a Doji

- The pattern is more potent also if the black candlestick penetrates more the white candlestick’s real body

- Effect: Signals a top reversal pattern

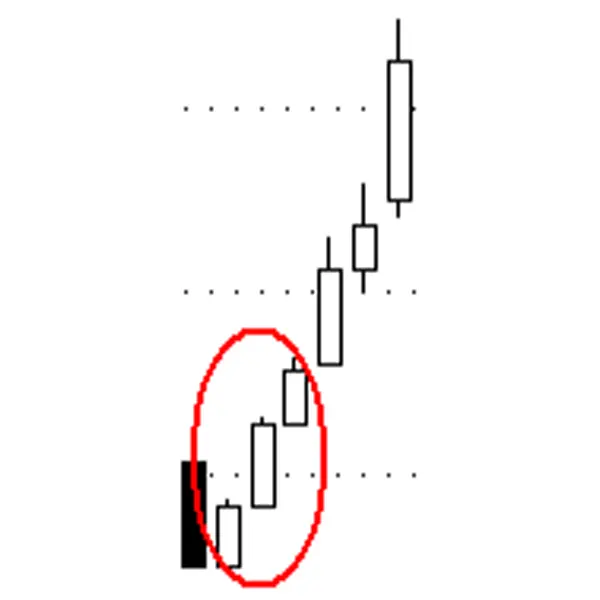

Three White Soldiers

- Appears as a group of three white candlesticks with consecutively higher closes

- As much as possible each white candlestick should open near or within the prior session’s white real body and close at or near its highs

- Also known as the Three Advancing Soldiers

- Effect: Signals strength ahead if pattern appears after a period of stable prices

Three Black Crows

- Appears as a group of three black candlesticks with consecutively lower closes

- As much as possible each black candlestick should open within the prior candlestick’s real body and closes at or near their lows

- Effect: Signals bearishness ahead

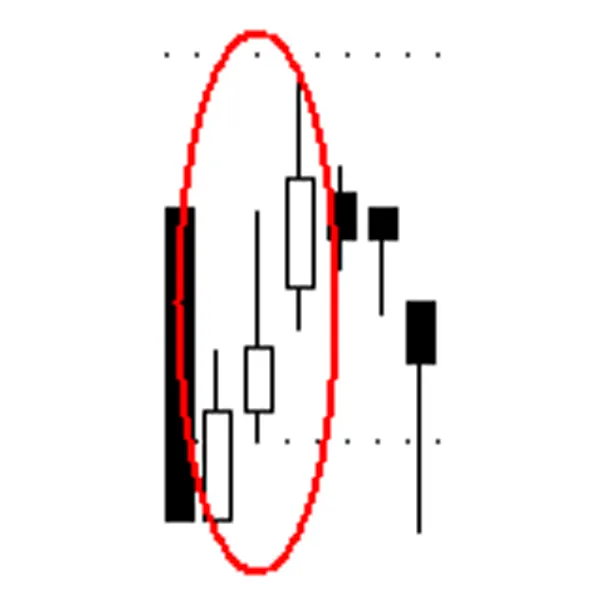

Stalled Pattern

- Appears a group of three white candlesticks with the first two white candlesticks possessing long real bodies whereas the third white candlestick possesses a small a real body.

- The second candlestick must close higher than the first candlestick and usually the third candlestick closes higher than the second candlestick, but not that far from the previous day’s close.

- The third candlestick can either gap away or ride on the shoulder of the second candlestick (usually forms a Doji star, Spinning Top, or Shooting Star)

- Also known as the Deliberation pattern

- Effect: Signals that the bull’s strength has been temporarily exhausted and the stock may experience correction or a reversal

Advance Block Pattern

- Appears as a group of three white candlesticks with progressively smaller white real bodies or relatively long upper shadows on the latter two white candlesticks

- Each white candlestick closes above the previous day’ close

- Effect: Signals weakening of the stock and can correct or reverse soon

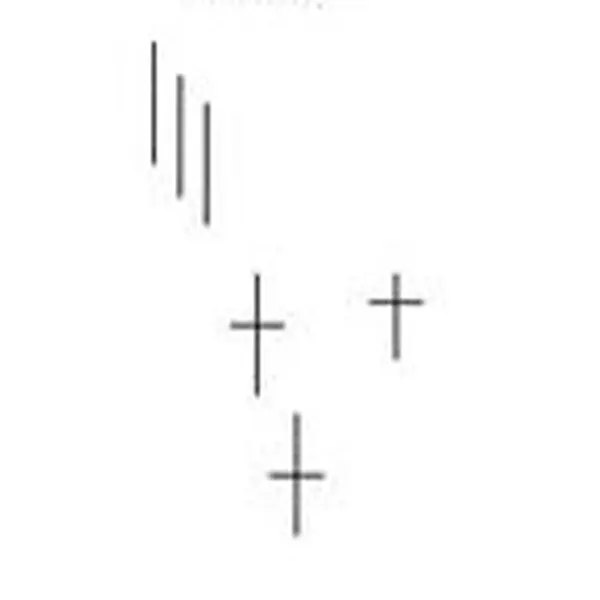

Tri-Star Bottom

- A rare pattern that forms in a downtrend

- Appears as a group of three consecutive Doji stars with the second Doji gapping below the first and third Doji star

- A bullish candlestick on the fourth day is important to confirm the effect of the pattern

- Effect: Signals a major reversal from its downtrend

Tri-Star Top

- A rare pattern that forms in an uptrend

- Appears as a group of three consecutive Doji stars with the second Doji gapping above the first and third Doji star

- A bearish candlestick on the fourth day is important to confirm the effect of the pattern

- Effect: Signals a major reversal from its uptrend